An alternative choice is Camper money, since particular tiny properties are made to your tires and you can categorized because amusement vehicles

Likewise, it is important to think about the value and durability of a little home. As they have a lower purchase price versus old-fashioned property, you will want to however cautiously examine your finances and make certain you can be comfortably afford the month-to-month home loan repayments or loan payments. More over, you should also consider the new long-identity expenses associated with repairs, resources, and insurance policies.

Financing Limits and you will Terminology

When it comes to to shop for a little household playing with good Veteran’s Items (VA) financing, it’s imperative to understand the financing constraints and terms and conditions with the these types of money. Here are a few crucial facts to consider:

- Loan Limits: Brand new Va provides particular financing constraints you to dictate the most you might obtain. This type of limits are very different in accordance with the county the spot where the home is found. It is necessary to see the current loan limits in your area to make sure their little home drops when you look at the recognized variety.

- Mortgage Conditions: Virtual assistant finance render positive terminology so you’re able to pros, and additionally aggressive interest rates and flexible installment options. The borrowed funds terms and conditions normally start from fifteen so you’re able to thirty years, enabling you to favor a fees bundle one to aligns with your monetary needs.

- Most Will set you back: Since Virtual assistant financing talks about the expense of the little family, it is critical to make up more costs such as closing costs, insurance rates, and you will taxation. Definitely plan for these types of can cost you to avoid any shocks when you look at the property process.

Knowing the financing limits and you may terms of good Va financing try essential to make certain a silky and profitable purchase of their small domestic. By familiarizing oneself with the facts, you may make advised choices and you can contain the investment you desire to make your lightweight family desires to the reality.

Looking for a lender

Discover a lender to have an excellent Veteran’s Points (VA) financing to buy a tiny house because of the comparing and you will getting in touch with approved Virtual assistant lenders in your area. Regarding interested in loan providers for a beneficial Virtual assistant mortgage, you should pick one that is acquainted with the specific requirements and you will benefits associated with the Va financing program. From the handling a medication Virtual assistant financial, you could make sure that you will have use of the loan possibilities that are offered to you personally as the a veteran.

First off your hunt to have a loan provider https://paydayloanalabama.com/florence/, you can visit the state website of your You.S. Company of Experts Facts. They give you a list of recognized Va loan providers that one can get in touch with to find out more. As well, you could reach out to regional banking companies and you can borrowing unions so you can request its Va mortgage apps. You will need to find out about the experience in Va funds and its familiarity with the unique areas of to invest in a small family.

When calling loan providers, make sure you ask about the loan selection they give you having to invest in a little home. Some lenders possess particular criteria otherwise restrictions in terms in order to financing a small family. It is vital to get a hold of a lender exactly who understands exclusive nature away from tiny house funding and will supply you with the greatest financing options for your circumstances.

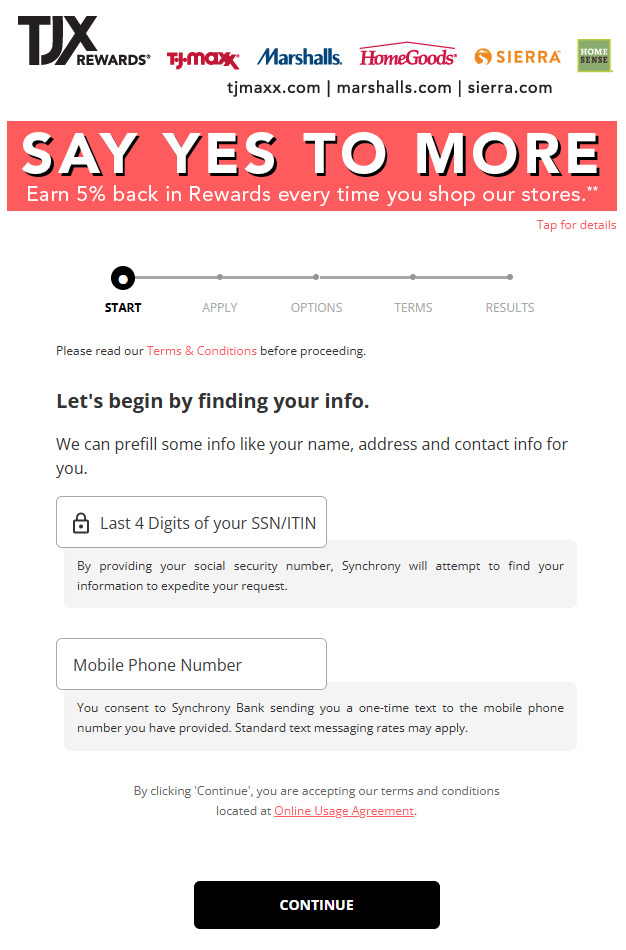

Applying for a great Virtual assistant Mortgage

To apply for a beneficial Virtual assistant loan, its necessary to assemble most of the necessary data files and meet with a medication financial who’ll guide you from app processes. Here you will find the actions you really need to try be sure a flaccid and winning Va financing process:

- Assemble the required files: Ahead of interviewing a loan provider, make sure you have the necessary papers in a position. Which generally speaking comes with proof of income, bank comments, tax returns, and your Certificate out-of Qualification (COE). Which have these data prepared will assist facilitate the applying procedure.