Choice You can try if you’re unable to Qualify for a personal Financing If you find yourself Out of work

Loan providers cautiously look at some areas of debt pointers once you get financing. These points were your earnings, the fresh new ratio of debt to income, along with your credit rating. These points with each other give lenders information into the economic stability https://speedycashloan.net/personal-loans-al/, power to do obligations, and creditworthiness.

Keeping an excellent equilibrium ranging from these types of circumstances is vital so you’re able to protecting mortgage acceptance with positive terminology. At the same time, one weaknesses might require hands-on strategies to change your financial standing before you apply for fund.

Against mortgage rejection because of jobless can be unsatisfying. Nonetheless, you will find solutions you can talk about and you may change your probability of being qualified for a loan otherwise fool around with since the choices:

Pertain With an excellent Cosigner

Consider applying with an excellent cosigner in case the jobless standing affects the mortgage eligibility. A beneficial cosigner try people having a stable income and you may good credit who believes to blow the loan if you cannot. Lenders measure the cosigner’s creditworthiness, improving your likelihood of acceptance and protecting a lot more good terms and conditions. Going for an eager and you can able to cosigner is very important because their borrowing from the bank and you can funds will be in danger.

Score a shared Mortgage

A mutual loan is when you apply for financing which have some one having good credit. This individual shall be a member of family otherwise others. Couple will use your revenue when being qualified to have a beneficial consumer loan.

You can use practical funds for different objectives, including domestic sales or personal expenses. Both parties are responsible for repayment; later payments or non-payments could affect both credit file.

Make an application for a house Collateral Credit line (HELOC)

If you individual property and now have accumulated guarantee, consider making an application for property Equity Line of credit (HELOC). An excellent HELOC makes you borrow against the fresh new collateral on your house, utilizing it just like the guarantee. Since your house obtains the mortgage, loan providers can be a whole lot more lenient regarding the a position reputation. However, be careful, since failure to repay a beneficial HELOC you could end up dropping your household.

Choices so you can Unemployment Funds

When against financial difficulties because of jobless, several solution supply to possess unemployment finance helps you browse these difficult minutes:

Get in touch with Present Loan providers getting Financial help

Contact your latest creditors, such as credit card companies, loan providers, borrowing from the bank unions, otherwise energy team. Identify your situation in all honesty and have when they provide hardship programs, temporary percentage decrease, otherwise deferred commission alternatives. Of a lot financial institutions will work to you throughout the monetaray hardship to get rid of default.

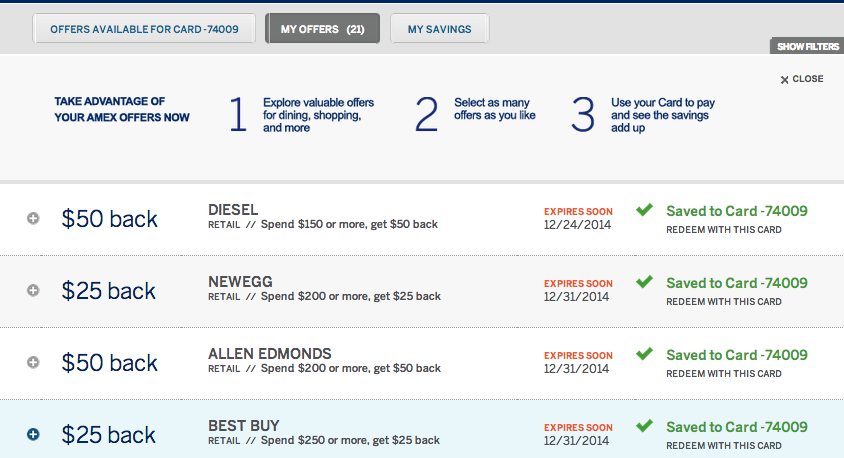

Low-attention Credit card

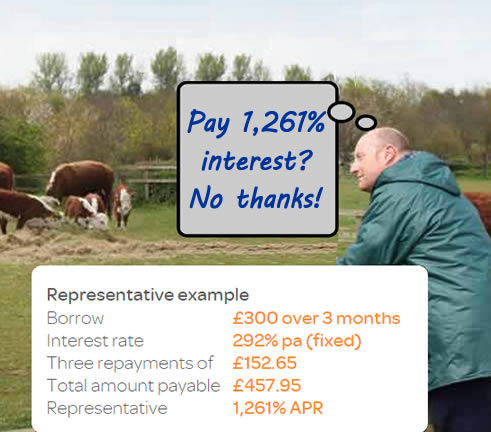

A charge card having a minimal-interest rate otherwise good 0% Apr render may benefit necessary expenses. Be mindful not to ever accumulate higher credit card debt, however, this option is much more costs-active than simply highest-attention financing.

Obtain Away from a pension/Capital Membership

Imagine you have got a pension account otherwise investment profile. Therefore, some of these membership get enables you to borrow secured on all of them temporarily in the place of charges. This may offer accessibility loans when you are to stop very early withdrawal costs otherwise taxation. Although not, it’s important to comprehend the terminology and you may prospective long-label affect pension savings account.

Nearest and dearest & Friends

Contact nearest and dearest otherwise close friends exactly who may be willing and ready to give financial help. Borrowing from the bank off family is a viable alternative, commonly as opposed to focus or rigorous repayment words. not, it is necessary to expose obvious plans and payment plans to look after suit dating.

Jobless Insurance

Unemployment insurance is a federal government-paid monetary back-up made to promote short-term financial help so you’re able to whoever has lost its work and you may satisfy specific qualifications standards. It is a valuable alternative to taking right out financing when you are out of work.