Exactly what Money Do you want to Pay for a beneficial $500k Household?

Of the Kelsey Heath

The fresh average price of property along side You has increased easily for the past long-time. Even after over the years high interest levels, housing cost across the of many segments remained resilient, and you will prices are still highest.

At the time of the termination of 2023, this new average household pricing is over $430,000. Whenever you are cost are still higher, the borrowed funds matter people normally qualify for has evolved substantially. Very, exactly what earnings could be must afford a $500k domestic?

The solution alter predicated on business conditions and personal economic points. Generally, just how much earnings you would like for a great $500k house depends on the pace you earn and exactly how far money you place down navigate to this website because the in initial deposit.

Yet not, individuals may also have its credit rating and personal debt-to-income ratio examined, hence influences its borrowing ability. If you’re questioning when you can manage a $500,000 house, this information is good starting publication before you could contact an excellent bank.

Key factors Affecting Domestic Cost

When purchasing a house, you will find several key factors affecting property affordability outside of the cost. For these taking financing, their price is very important. But what gets the very affect their financial situation was the borrowed funds terms it get as well as their month-to-month homeloan payment.

Their monthly mortgage payment determines how large out-of that loan you is be eligible for. When rates of interest try large, customers be eligible for an inferior financing due to the fact interest grows the month-to-month costs.

Mortgage Costs and you will Terminology

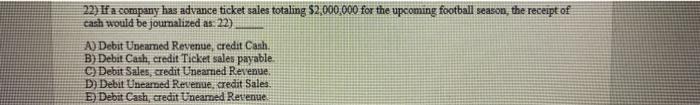

While looking for an effective $five-hundred,000 family, mortgage prices and you can financing words enjoys a giant influence on value.