New effects from fees and you will attention charges to the home security loan forbearance cannot be skipped

People that are unable to resume mortgage payments once forbearance is to find qualified advice out-of a homes specialist or economic mentor. These masters offer pointers and you will service to simply help property owners prevent default and maintain their houses.

To summarize, understanding the Restricted Course: Forbearance is typically provided to own a small date, thus people is plan for resuming money. facet of domestic equity financing forbearance is essential. Homeowners will be very carefully review their forbearance arrangements, arrange for slowly resuming mortgage repayments, and look for expert advice if needed to get rid of standard and keep maintaining their houses.

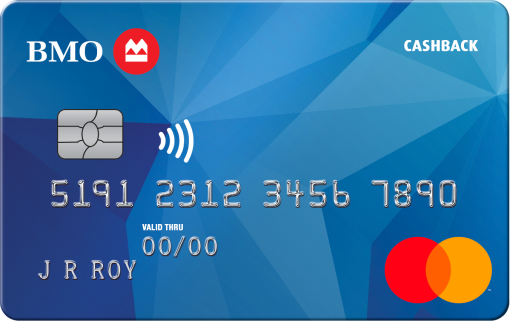

Costs and Desire

![]()

Household equity loan forbearance, when you’re taking temporary respite to help you property owners up against monetaray hardship, will come having relevant charges and you can attention fees. Understanding such prospective costs is crucial getting people offered forbearance since a monetary guidance option.

Forbearance programs can differ inside their payment structures. Specific lenders can charge an initial commission getting getting into good forbearance arrangement. At the same time, some software will get accrue notice toward overlooked mortgage repayments while in the the brand new forbearance months.